Tax Loss Harvesting for Crypto Investors: Strategies, Rules, and IRS Risks

Key Takeaways:

-

Tax loss harvesting lets you sell losing crypto positions to offset gains and reduce taxable income.

-

U.S. taxpayers can deduct up to $3,000 of net capital losses annually against ordinary income, with the rest carried forward.

-

The wash sale rule currently does not apply to crypto, but Congress may close this loophole soon.

-

December is the last chance each year to realize crypto losses and reduce your IRS liability.

As the holiday season approaches, it's not just about giving gifts, embarking on memorable travels, or reuniting with distant family members.

It's also a crucial time for savvy financial planning, particularly for cryptocurrency investors. The end of the year signals an opportune moment to assess and optimize your crypto tax situation.

The phrase 'tax loss harvesting' is likely a familiar term echoing in the minds of many crypto investors.

But beyond its repeated mentions, how can you effectively employ this straightforward yet potent strategy to significantly reduce your crypto tax liabilities for the current year?

This article delves into the art of tax loss harvesting, demystifying its complexities and guiding you towards a financially smarter year-end.

What is Tax Loss Harvesting in Crypto?

Tax loss harvesting refers to selling (or disposing) of losing positions in order to realize such losses, thus being able to deduct them from your taxes.

When you purchase an asset and its price decreases relative to your purchase price, you have an unrealized loss. You cannot deduct unrealized losses from your taxes until you close that position by selling or disposing of it.

Just like you pay tax on any capital gains, US tax law allows taxpayers to use any capital losses to offset those capital gains and thus minimize your tax liability.

This is a powerful yet often overlooked strategy by many investors.

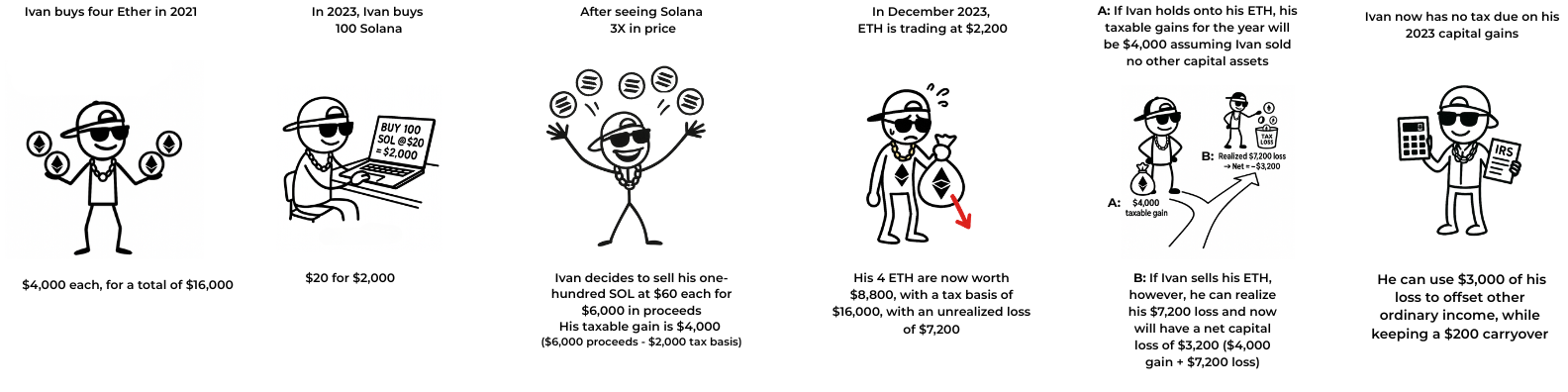

To illustrate, consider the following example:

When Should Crypto Investors Use Tax Loss Harvesting?

As illustrated by the previous example, tax loss harvesting can be extremely beneficial, especially in a year in which investors have taxable gains.

This is because American taxpayers pay tax on their net capital gains - after netting all taxable gains and losses.

But what if it is a bad year for the markets, such as 2022? Tax loss harvesting can also be valuable in years with decreasing prices.

Even if you have no realized gains for the year, any taxable losses will provide a tax benefit.

While US taxpayers can only deduct $3,000 of a net capital loss against ordinary income (such as wages, business income, interest, dividends) in a given tax year, any excess losses over $3,000 will get carried over to the following tax year.

Even if you have no capital gains the following year, you can deduct another $3,000 each year against ordinary income and so forth, until you have more capital gains to deduct this from.

To illustrate, suppose that Alex loses $100,000 in 2022 and has no other capital gains in the year.

Alex can deduct $3,000 of these losses against other income, while he can carry over $97,000 of capital losses to future tax years.

If Alex has $105,000 of gains in 2023, he can use his $97,000 of capital losses to reduce his 2023 gains to only $8,000 of taxable gains.

While no investor wants to lose money, the silver lining is that for every dollar loss, you can offset that against other gains. In the previous example, Alex would only pay tax on a $8,000 gain in 2023 while actually realizing $105,000 in taxable gains.

How Does the Wash Sale Rule Affect Crypto?

The Internal Revenue Code §1091 states that:

“In the case of any loss claimed to have been sustained from any sale or other disposition of shares of stock or securities where it appears that, within a period beginning 30 days before the date of such sale or disposition and ending 30 days after such date, the taxpayer has acquired (by purchase or by an exchange on which the entire amount of gain or loss was recognized by law), or has entered into a contract or option so to acquire, substantially identical stock or securities, then no deduction shall be allowed under section 165 unless the taxpayer is a dealer in stock or securities and the loss is sustained in a transaction made in the ordinary course of such business. For purposes of this section, the term “stock or securities” shall, except as provided in regulations, include contracts or options to acquire or sell stock or securities.”

What this means is that if a taxpayer sells assets at a loss and acquires the same asset, either 30 days before or after the sale triggering the loss, the taxpayer will not be allowed to deduct this loss.

Instead of deducting the loss, the loss gets deferred until the taxpayer sells the replacement asset.

This is done so that taxpayers cannot claim a tax loss while remaining in the same economic position, as this is merely a tax scheme.

It is worth noting that the United States is not the only country to have laws against wash sales - many other jurisdictions also have their own laws to prevent this, such as Canada, the UK and Australia.

Does the Wash Sale Rule Apply to Crypto Assets?

This has been a loophole that crypto investors in the US have enjoyed for a number of years now. If you read §1091, you will see that it refers to ‘stocks or securities’.

As we know, for tax purposes, crypto assets are considered property, not stocks or securities.

This means that crypto investors can technically sell their losing positions to realize tax losses and buy it all back immediately, remaining in the same economic position and claiming their tax loss.

This is seen as an aggressive strategy by some professionals as the IRS and Congress are very aware of this existing loophole.

The Build Back Better Act contained a provision to close this loophole and make the wash sale rule applicable to digital assets.

Even though this was not passed into law, every conversation in Congress centered around digital asset tax reform has contained provisions to make the wash sale rule applicable to digital assets.

While no one knows with 100% certainty whether the wash sale rule will in fact be applicable to crypto assets in the future, it is worth noting that this is seen as a revenue generating provision and the likelihood that it will pass in the near future is extremely high.

So does that mean you can continue to harvest tax losses and purchase back the same assets within a 30 day period without worrying about deferring such losses? It depends on your risk tolerance.

If you are very risk averse and prefer not to worry about a retroactive change in tax law, or scrutiny by the IRS, we recommend waiting at least 30 days before purchasing back the same asset.

What Are Smart Tax Loss Harvesting Strategies?

Whether you have taxable gains for the year or not, it is always a good idea to regularly re-evaluate your investments.

This is true whether you are a crypto or equity investor, as fundamentals of a crypto project or company can change significantly from year to year.

Just because a company or project was a good investment when you purchased, it does not necessarily mean that is still the same case today.

The most successful investors are able to take in new information and re-evaluate their investment decisions periodically.

Many investors traditionally do this exercise in the month of December.

This is because December is the last month that you can sell any losing positions to claim those losses in the current tax year.

Re-evaluating your position and selling your losing positions can not only optimize your taxable gains, but it will help your overall investment portfolio.

Remember, many coins that performed very well in previous cycles never come back (e.g., EOS, IOTA).

What if you wish to sell some losing positions to claim the tax losses, but still want exposure to the same asset?

For example, what if you bought Bitcoin at $65,000 and need that loss, but you believe that Bitcoin will continue to increase in price?

One option would be to sell your BTC and purchase wBTC.

However, regulators have not commented whether purchasing essentially the same asset, but wrapped, would constitute as a different asset for the purposes of the wash sale rule, so this continues to have some risk.

If you want to minimize your risk, you could sell your BTC and purchase a correlated asset, whether another coin that moves with BTC or perhaps the stock in a Bitcoin mining company.

Why Timing Matters for Crypto Taxes

Tax loss harvesting can be an extremely effective way for crypto investors to minimize their tax liability, but there are some risks if you don’t plan this well.

One must be cognizant of the rapidly evolving tax laws and make sure you understand the risks. Furthermore, it is critical for investors to keep track of their historical cost (tax basis) of their assets, whether by using the right tools or working with a tax professional to actively help you plan for taxes.

At CryptoTaxAudit, we don’t just calculate your taxes. We defend you against IRS scrutiny. If you’re considering selling large losing positions or want to lock in tax savings before year-end, our team will help you plan the smartest moves and avoid audit risk.

Protect your portfolio today. Schedule your private consultation now at CryptoTaxAudit.com.

Related Article: Learn how FIFO, LIFO, and HIFO accounting methods impact your crypto gains in our full guide.

Frequently Asked Questions About Crypto Taxes

Q: Does the IRS wash sale rule apply to crypto?

A: Currently, no. Crypto is considered property, not securities, so the wash sale rule doesn’t apply. But Congress has proposed closing this loophole, so CryptoTaxAudit recommends waiting 30 days before rebuying to reduce risk.

Q: Can I deduct unlimited crypto losses on my taxes?

A: No. You can only deduct $3,000 of net losses per year against ordinary income. Any remaining losses carry forward until used. CryptoTaxAudit helps clients track and maximize these deductions.

Q: What happens if I don’t harvest losses before year-end?

A: You lose the chance to apply them against that year’s gains. December 31 is the deadline. Working with CryptoTaxAudit ensures you don’t miss this key tax strategy.

Q: What if I sell Bitcoin at a loss but want to keep exposure?

A: You could buy a correlated asset, like a Bitcoin mining stock, or switch into wrapped Bitcoin, though the IRS hasn’t clarified whether WBTC counts as the same asset. CryptoTaxAudit can advise on the safest approach.