A crypto tax expert, Clinton Donnelly detailed an IRS cryptocurrency timeline from 2013 to the present. It's an interesting journey through time from the earliest guidance in 2013 to the latest updates used by taxpayers in 2023.

The beginning of the IRS crypto timeline.

Before we begin, not all advice and guidance provided by the IRS are legally binding on the taxpayer. Please keep that in mind.

2013-2015.

The IRS served a “John Doe” summons on Coinbase seeking information from accounts “with at least the equivalent of $20,000 in any one transaction type (buy, sell, send, or receive) in any one year” during the 2013-2015 period.

April 2014.

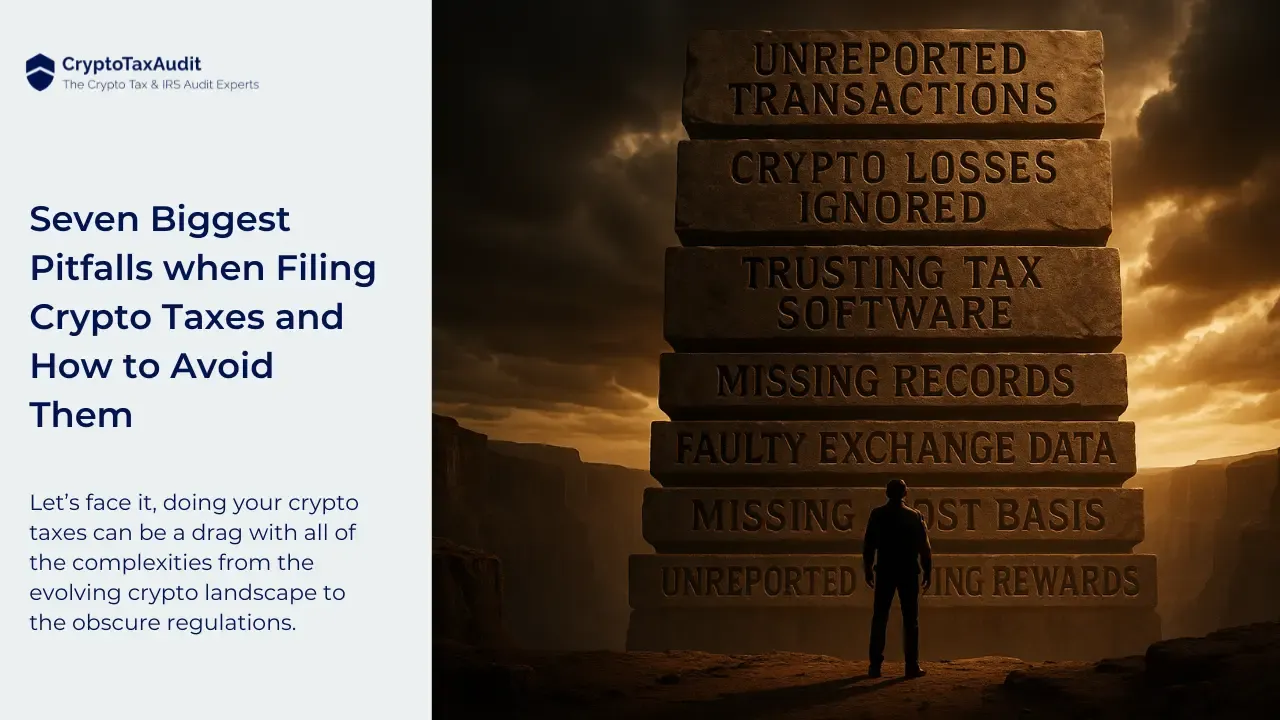

The IRS released Notice 2014-21 (the Virtual Currency Guidance) accompanied by several FAQs with references to several publications: “Taxable and Nontaxable Income”, “Basis of Assets”, “Withholding of Tax on Nonresident Aliens and Foreign Entities”, and more.

December 12, 2014.

Treasury Decision TD-9706 solicited comments on the proper reporting of virtual currency as Specified Foreign Financial Assets on Form 8938.

May 6, 2016.

The IRS & the FBI announced a legal victory of the 20-year imprisonment of the founder of Liberty Reserve for money laundering. Liberty Reserve was a non-blockchain virtual currency.

November 8, 2016.

The Treasury Inspector General for Tax Administration (TIGTA) warned the IRS that better guidance was needed on reporting the tax implications of virtual currency transactions.

FAQs are considered non-binding to taxpayers.

July 26, 2017.

IRS Taxpayer Advocate callsed IRS FAQs a trap for the unwary. Note that FAQs are non-binding to the taxpayer.

March 2018.

The IRS reminded taxpayers that income from virtual currency transactions is reportable on their income tax returns. Wrongfully reported income tax could be considered tax evasion and include a fine of up to $250,000 or 3 years in prison.

July 2018.

The IRS announced through the Withholding & International Individual Compliance Area: “U.S. persons are subject to tax on worldwide income from all sources, including transactions involving virtual currency.” (Of course, at the time, many crypto traders may not have known what was meant by the “virtual currency” label applied to crypto by the IRS.)

July 13, 2019.

The IRS released a press release about the achievements of the J5, a five-nation task force created to coordinate investigation and enforcement efforts in tax evasion including the area of virtual currencies. The J5 have built the FCInet as a decentralized virtual computer network that enables agencies to compare, analyze, and exchange data anonymously. It helps users to obtain the right information in real time and enables agencies from different jurisdictions to work together while respecting each other's local autonomy. Organizations can jointly connect information, without needing to surrender data or control to a central database. FCInet doesn't collect data. Rather it connects data.

The IRS began sending virtual currency education letters.

July 2019.

The IRS started sending educational letters (6173, 6174, 6174-A) to taxpayers during the last week of July 2019. By the end of August, more than 10,000 taxpayers had received these letters. Taxpayers’ names were obtained through various ongoing IRS compliance efforts.

October 9, 2019.

The IRS released Revenue Ruling 2019-24, providing further guidance on Airdrops and Hardforks.

The IRS also published a list of frequently asked questions about virtual currencies. This document was revised again a few months later.

January 2020.

The IRS added the “crypto question” to Form 1040 for the 2019 tax year: At any time during 2019, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?

February 2, 2020.

The IRS & the FBI announced that an Ohio resident was charged with operating a darknet-based bitcoin “mixer,” which laundered over $300 million.

February 2020.

The U.S. Government Accounting Office (GAO) published a report GAO-20-188 stating the IRS guidance in 2014 & 2019 was not clear as to which parts were authoritative and which parts were subject to change. The IRS and the Financial Crimes Enforcement Network (FinCEN) had not clearly and publicly explained when, if at all, requirements for reporting financial assets held in foreign countries applied to virtual currencies (Forms 8938 and FBAR).

March 2, 2020.

The IRS & the FBI charged two Chinese nationals with laundering over $100 million in cryptocurrency from a crypto exchange hack.

March 2020.

The IRS invited crypto companies to discuss how they “balance taxpayer service with regulatory enforcement”. This consisted of panels on technology updates, tax return preparation, and more.

May 2020.

The IRS requested that crypto tax software companies help with crypto tax audits

July 2020.

The IRS began seeking contractors to uncover privacy coin transactions.

July 22, 2020.

The IRS Criminal Investigation won a crypto enforcement case. A man admitted to operating an unlicensed ATM network that laundered millions of dollars of Bitcoin and cash for criminals’ benefits.

August 4, 2020.

The IRS and the DEA announced that an American darknet vendor and Costa Rican pharmacist was charged with narcotics and money laundering using virtual currency.

Crypto tax reporting becomes a top IRS priority.

August 2020.

The IRS released a draft for the new 1040 form moving the “Yes” or “No” virtual currency question which asks, “At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency? Yes or No” from Schedule 1, an optional schedule, to the top of the new 1040 form. (This signaled the growing importance the IRS was now placing on crypto tax reporting and enforcement.)

August 14, 2020.

Te IRS begins the second round of virtual currency education letters dated August 14, 2020.

August 28, 2020.

An IRS memo says that cryptocurrency earned from carrying out microtasks is taxable. In Chief Counsel Advice #202035011, the IRS outlined the government’s position on the taxability of convertible virtual currency received in exchange for microtasking through crowdsourcing or other similar platforms.

The IRS offers rewards to hack a privacy crypto.

September 4, 2020.

The IRS offered a reward of $625,000 to anyone who can “reliably produce useful results on a variety of real-world CI cryptocurrency investigations involving Monero and/or Lightning" reflecting a new approach by the IRS to use rewards to hack cryptocurrency, a field dominated by hackers. Proposals were due Wednesday, September 16, 2020, at 08:00 EDT.

September 8, 2020.

The IRS’ criminal investigation department signed a $249,900 contract with a blockchain analytics firm called Blockchain Analytics and Tax Software, LLC, to amplify crypto tracing tools.

September 30, 2020.

The IRS awarded a contract labeled “Pilot IRS Request for Proposal Cryptocurrency Tracing” for $625,000 to Chainalysis, Inc. to develop a tool to crack privacy coins like Monero and/or Lightning.

October 2020.

Per the draft for the new 1040 form instructions, anyone who sold cryptocurrencies, received airdrops, or exchanged cryptocurrencies for goods, services, and other assets must report “yes” to the question: At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?

The IRS latest update stated that a transaction involving virtual currency includes:

- The receipt or transfer of virtual currency for free, including from an airdrop or hard fork;

- An exchange of virtual currency for goods or services;

- A sale of virtual currency; and

- An exchange of virtual currency for other property, including for another virtual currency.

The IRS also stated that users who held crypto in their wallets or transferred cryptocurrencies between their own wallets are not liable. The draft instructions on Form 1040 were likely to be considered final unless unexpected issues required further changes.

December 31, 2020.

The IRS published updated instructions for Form 1040 on December 31. They included additional information on how to answer the cryptocurrency question on the main tax form individuals use to file U.S. tax returns.

The tax form put the virtual currency question at the top, right after your name and address, and even before you state how much your wages were! The message was loud and clear that the IRS is taking a very aggressive position on cryptocurrency reporting. The average taxpayer should take a very serious approach to reporting all their income.

IRS FAQ #5 causes more questions.

March 2, 2021.

On March 2, the IRS updated Question #5 of the Frequently Asked Questions (FAQs) on virtual currency transactions. The new FAQ raised more questions than it answered, which further confused crypto owners regarding how to answer the new Form 1040 question.

FAQ #5 stated that taxpayers whose only crypto transactions include the purchase of virtual currency with real currency do not need to answer "yes" to the new Form 1040 question. The IRS FAQ #5 refers to how to answer the new 1040 virtual currency question for crypto owners that solely bought crypto but never traded it. However, this answer conflicted with the virtual currency question on the new Form 1040, which asked simply if you had "any financial interest in virtual currency."

Crypto tax tip: If you buy virtual currency (a crypto currency, a digital token, an NFT, or another digital asset), you have a financial interest.

Although the FAQ is not legally binding, answering "no" when you own any virtual currency is considered perjury.

Crypto tax tip: Everyone should answer "yes" to the virtual currency question on the new Form 1040.

The story continues.

January 2023.

The IRS changed the Form 1040 question renaming “virtual currency” as “digital assets”. The question remained as the first question of Form 1040.

More to come.

More changes are expected in the months and years ahead. This may include a new 1099-FA or similar form for U.S. crypto exchanges to use in formally reporting digital asset (crypto) transactions to the IRS, similar to a brokerage report.

Hopefully more guidance will continue to come from the IRS, especially as the field of digital assets continues to grow and become more complex.

DISCLAIMER: Opinions and perspectives of the author, host, and guests. It should not be construed as U.S. taxpayer advice. There are often multiple interpretations of tax law. Various strategies may be suited to specific individuals and for particular situations. Seek out professional tax, legal, or financial advice from CryptoTaxAudit or from other reputable companies.